philadelphia wage tax work from home

While its difficult to determine how much of that loss is due to furloughs and layoffs as opposed to remote work the city typically collects 40 of its roughly 15 billion in annual wage taxes from. The previous guidance was published on.

Philadelphia Screwed Up Property Tax Assessments Start Over Editorial

Anyone who works in Philadelphia and lives in Middletown Township is subject to pay the non-resident Philadelphia Wage Tax which stands at a hefty 34481 as of July 1 2021 of gross wages.

. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non-resident taxpayers alike. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. The new rates are as follows.

Philadelphia nonresident employees are not subject to the citys wage tax for at-home work Residents are subject to the tax regardless of where they work Nonresident employees who usually work in Philadelphia but are required by employers to work outside the city including from home are not subject to the wage tax for time spent working elsewhere the department said in. A non-resident who works from home for the sake of convenience is not exempt from the Wage Tax even with his or her employers authorization. Philadelphia officials are clearing up any confusion about how the city wage tax could affect your refund.

In the span of one year this would equal a savings of about 1500. Non-resident employees who had City Wage Tax withheld during the time they were required to perform their duties from home in 2020 may file for a refund with an online Wage. The wages of the nonresident employees who are required to and do work at home are not subject to Wage Tax except on the days they report to the Philadelphia work location.

So many people are working from home during the pandemic and that could impact your taxes. Consistent with the citys current guidance that remote work must continue where feasible an employer has a policy that generally all employees should work from home if they are able to. Scrantons wage tax rate for residents is 34 of which 24 goes to the city and 1 to the Scranton School District.

Philadelphia updates Wage Tax guidance for employees ordered to work from home outside of the city for the employers convenience On May 4 2020 the Philadelphia Department of Revenue updated its guidance for withholding the Wage Tax from nonresident employees who are working in the city temporarily due to COVID-19. Prior to the pandemic city. Non-resident employees who work for Philadelphia-based employers are not subject to Philadelphia Wage Tax during.

For those who used to commute to work in Philadelphia there is yet another benefit to working from home besides saving time gas and tolls. In the state of California the new Wage. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work.

Philadelphia employers should ensure that their work-from-home policy explicitly indicates that the employees cannot work in the Philadelphia office. Philadelphia previously published guidance indicating if employees were required to work outside of the city by their employer they would no longer be subject to the Philadelphia wage tax. An Upper Makefield resident who was employed for 60000 by a Philadelphia-based business and required to work from home during the pandemic could save about 1500 over one year.

As you can imagine with many employees working from home during the pandemic this issue was very confusing as it related to City Wage Tax for non-residents and Philadelphia issued guidance in March of 2020 revised in November of 2020 that stated. Someone working from home in the suburbs during the pandemic making 60000 per year would be subject to their home municipalitys EIT which is typically 1. The wage tax accounts for 45 of Philadelphias annual revenue and is expected to decline by about 78 million this fiscal year despite an increase in the nonresident rate.

Everyone who lives in Philadelphia is subject to the City Wage Tax regardless of where they work. The simple answer is yes. The new NPT rates for calendar year 2019 are 38712 percent 038712 for residents and 34481 percent 034481 for non-residents respectively.

Plus the 1 you contribute instead will be invested in local improvements. SIT rates for residents have been increased to 38712 percent for. The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy.

Here are links to what you need to apply for a Wage Tax Refund. What is the city Wage Tax in Philadelphia. The City Department of Revenue also announced that employees working remotely from home in Philadelphia will be sufficient to give rise to business income and receipts tax nexus and must be taken.

What is Philadelphia city wage tax 2019. Philadelphia recently issued new streamlined ways to request City Wage Tax refunds that were withheld during the period their employer required to work from home outside of Philadelphia.

What Will Happen If Philadelphia Commuters Never Return

Configure Pennsylvania Local Taxes

Us Metro Economic Forecast Philadelphia

Philadelphia Issues New Wage Tax U O And Birt Guidance In Response To Covid 19 By Jennifer Karpchuk Chamberlain Hrdlicka Attorneys At Law Mid Market Multi Service Law Firm With Nationally Leading Tax Lawyers

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

The Cost Of Living In Philadelphia More Affordable Than Most Big Cities

What Will Happen If Philadelphia Commuters Never Return

These 8 People Open Up About Rage Quitting Their Jobs

Philadelphia Tax Abatement 2021 Homebuyer S Guide Prevu

Remote Alternative Work Arrangements Strategies For Success And Reducing Risk New Jersey Law Blog

Property Tax Bill Gone Missing Here S How To Get A New One Department Of Revenue City Of Philadelphia

The 5 Worst Things About Living In Philadelphia Pennsylvania Housely

Use Of Mortgages To Buy Lower Priced Homes Declines In Philadelphia The Pew Charitable Trusts

What Is Loop And Who Qualifies Department Of Revenue City Of Philadelphia

What Will Happen If Philadelphia Commuters Never Return

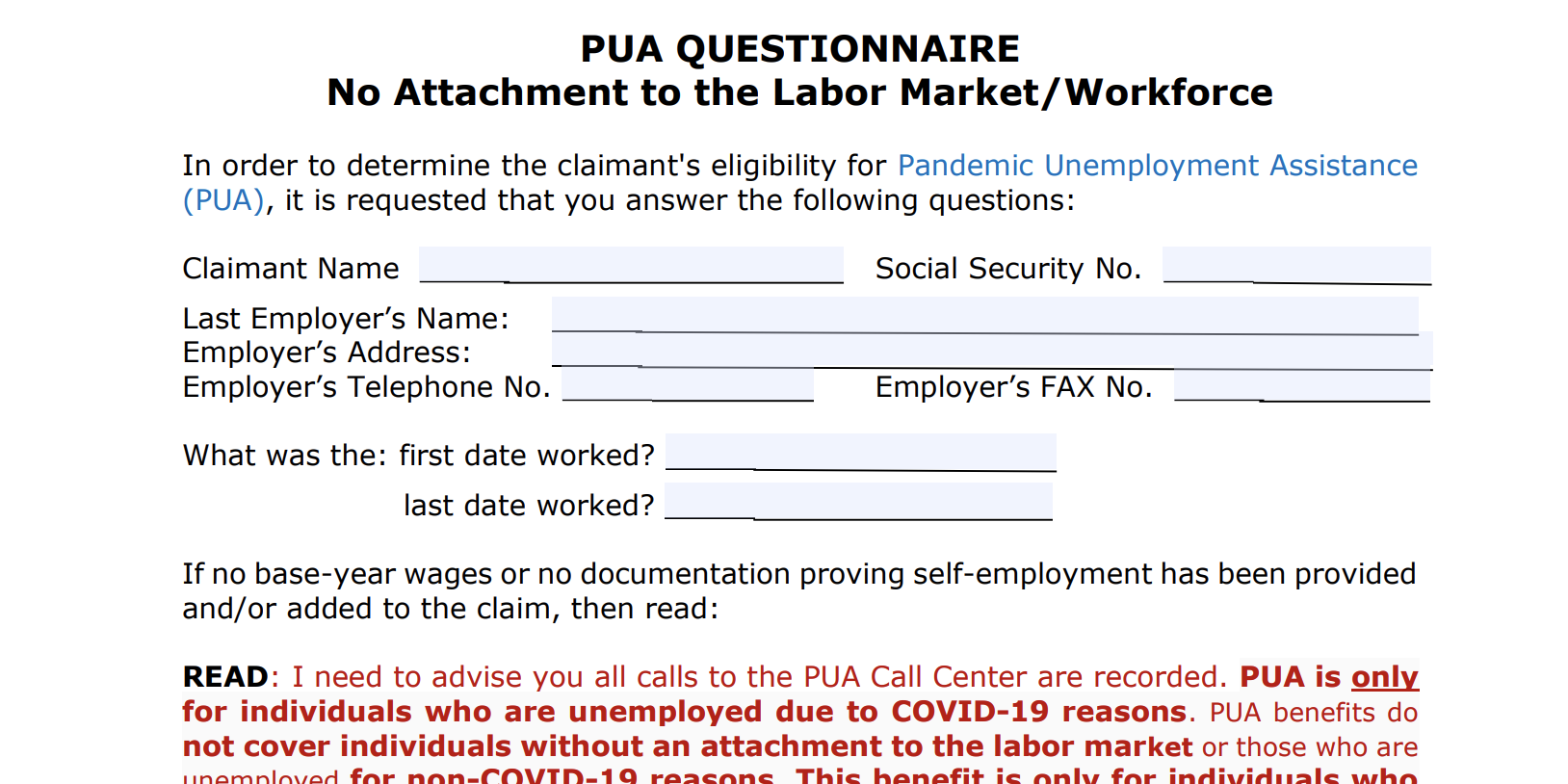

Do You Need To Prove That You Lost Work For Pua

The Cost Of Living In Philadelphia More Affordable Than Most Big Cities

Philadelphia Issues New Wage Tax U O And Birt Guidance In Response To Covid 19 By Jennifer Karpchuk Chamberlain Hrdlicka Attorneys At Law Mid Market Multi Service Law Firm With Nationally Leading Tax Lawyers

Philadelphia Estimates It Will Get 1 4b From Federal Stimulus Package Philadelphia Business Journal