owner draw vs retained earnings

The draw decreases the owners capital record and owners equity so now the equation will be. If you are the sole owner of the company then you own 100 percent of the shares.

What Is The Difference Between Owners Draw Retained Earnings Quora

There are two journal entries for Owners Drawing account.

. When you put money in the business you also use an equity account. At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account. Draws are pretty straightforward when 1 your company is a sole proprietorship a partnership or an LLC that is structured for tax purposes as either of the previous kinds of.

When you pay yourself a salary you decide on a set wage for yourself and pay yourself a fixed amount every. Retained earnings is where profits and losses get closed to at the end of the year. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

Retained earnings is where profits and losses get closed to at the end of the year. Arguably the main perk of an owners draw is flexibility. Owner draw is an equity type account used when you take funds from the business.

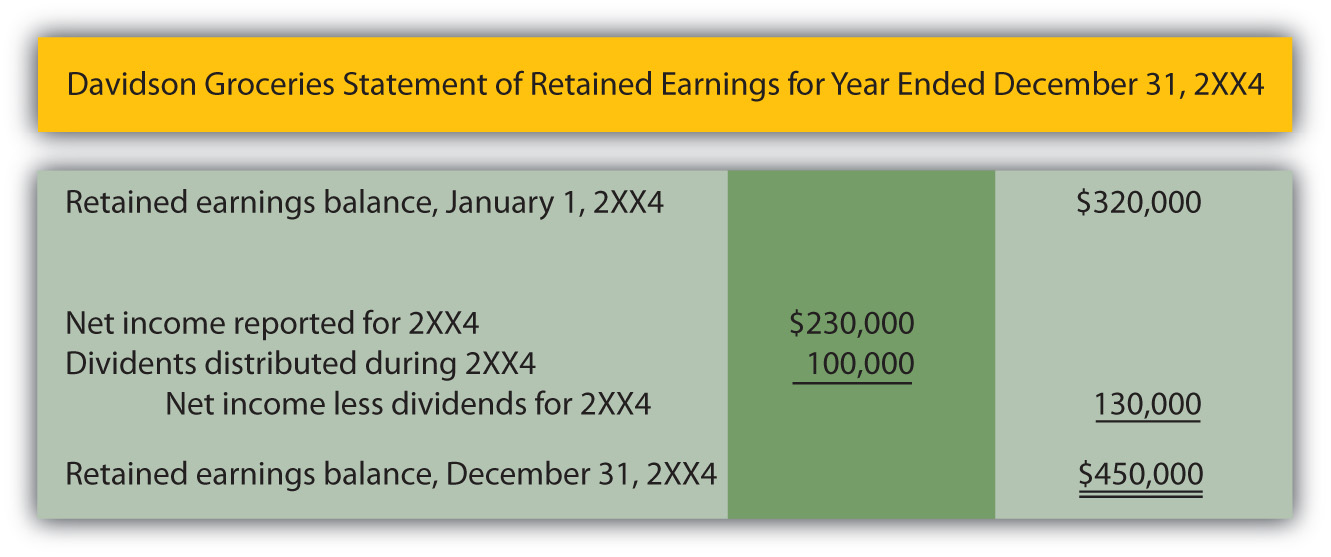

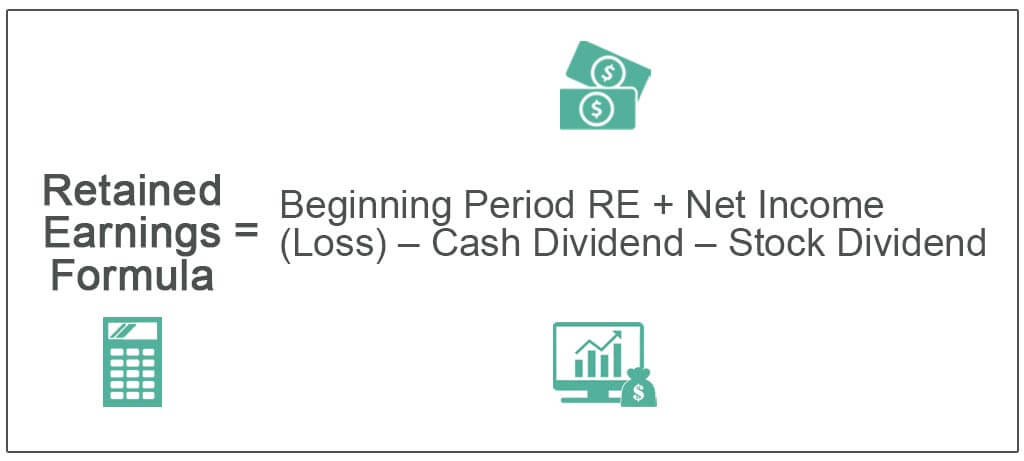

Owners equity refers to the total value of the company thats held in the hands of owners including founders partners and stockholders. Retained Earnings Accumulated Retained Earnings Last Year Net Income for Current Year. The business would record.

Retained earnings refer to the. As opposed to living paycheck-to-paycheck or having to put something off until you. The draw method Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use.

Personal funds the owner used to start up and operate the business and continues to contribute to it are kept in the Owners Capital account along with retained earnings from operations. It creates a negative drawings impact on the business. The retained earnings of a business at the end of a specific period can be calculated as follows.

The pros of an owners draw. If it is a proprietorship than it might be called owners capital rather than retained earnings but owners. Say for example that Patty has accumulated a 120000 owner equity balance in Riverside Catering.

First lets take a look at the difference between a salary and an owners draw. A corporation is owned by shareholders. Beginning RE of 5000 when the reporting period started.

So your chart of accounts could look. An owners draw is an amount of money an owner takes out of a business usually by writing a check. How do you close out owners draw to Retained Earnings.

If there are other owners besides yourself the ownership position of.

Temporary Vs Permanent Accounts Differences Examples Video Lesson Transcript Study Com

Owners Equity Net Worth And Balance Sheet Book Value Explained

Capital Equity Or Retained Earnings Nomenclature Matters Insightfulaccountant Com

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

Retained Earnings On The Balance Sheet Meaning Examples

![]()

Owner S Draws A Complete Guide To Owner Drawings Financetuts

Owner S Draws A Complete Guide To Owner Drawings Financetuts

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

:max_bytes(150000):strip_icc()/GettyImages-556673833-fe2bd734287544368bf79eb7c32c65d0.jpg)

Revenue Vs Retained Earnings What S The Difference

Paid In Capital Vs Retained Earning What Are The Key Difference Cfajournal

Increasing The Net Assets Of A Company

Retained Earnings Formula How To Calculate Step By Step

How To Calculate Retained Earnings Formula Example And More

Solved Am I Entering Owner S Draw Correctly

:max_bytes(150000):strip_icc()/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)

Balance Sheet Explanation Components And Examples

Retained Earnings Formula Youtube

Owner S Draw Vs Salary How To Pay Yourself Bench Accounting

What Is The Difference Between Owners Draw Retained Earnings Quora

:max_bytes(150000):strip_icc()/ownersdraw-59a909e0333d40e1a5409cb74251931f.jpg)